Is Tariff a Deflationary Event?

Is a Tariff a Deflationary Event? Lessons from 150 Years of History

In contemporary economic discourse, the standard assumption is that tariffs are inherently inflationary. The logic seems straightforward: by taxing foreign goods, a government raises the cost of imports, which then passes through to consumers as higher prices. However, a groundbreaking working paper from the Federal Reserve Bank of San Francisco provides empirical evidence that challenges this conventional wisdom.

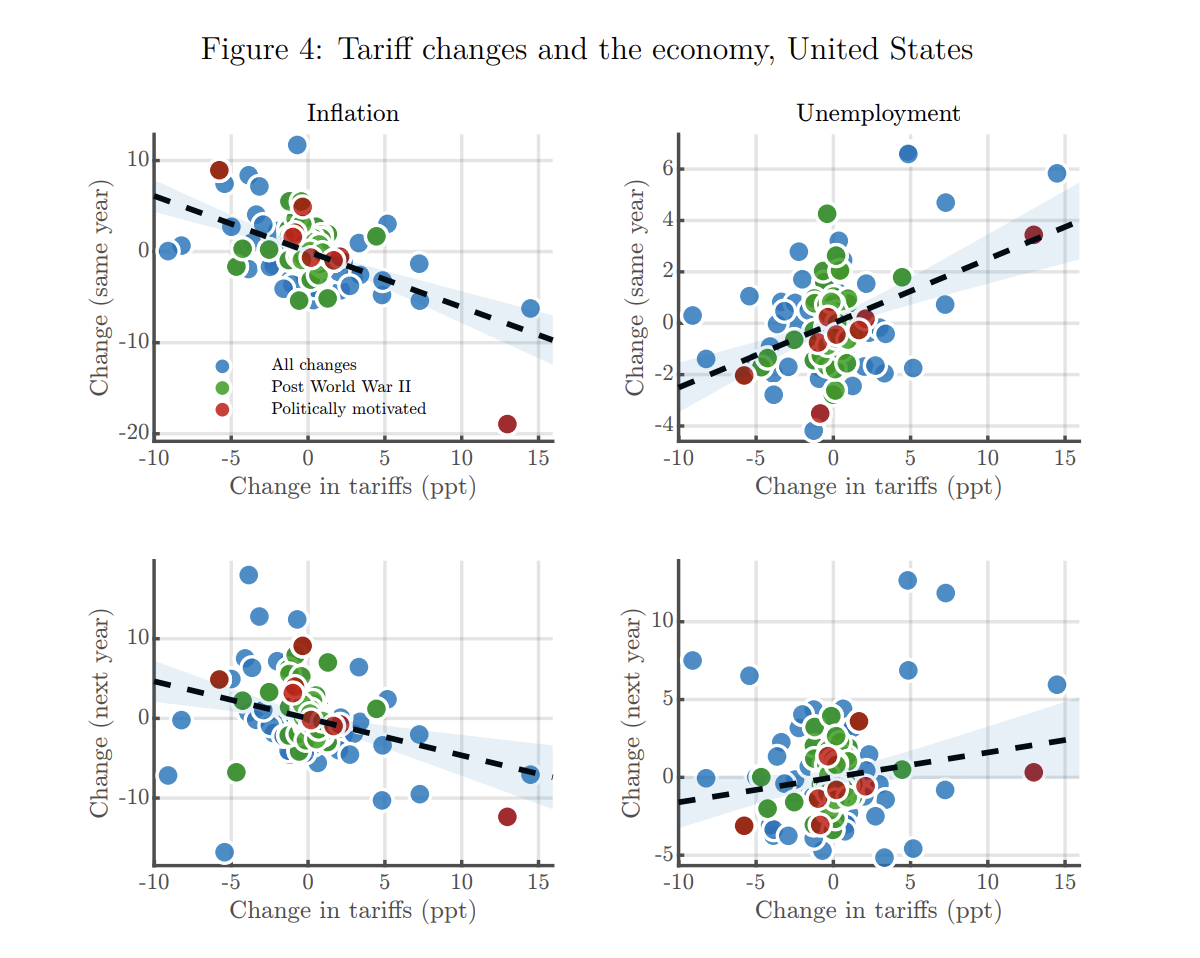

Drawing on 150 years of tariff policy data from the United States, France, and the United Kingdom, researchers Régis Barnichon and Aayush Singh conclude that, historically, a tariff hike is often a deflationary event that lowers CPI inflation and raises unemployment.

Source: FEDERAL RESERVE BANK OF SAN FRANCISCO

The "Quasi-Random" Nature of Tariff History

To identify the causal effects of tariffs, economists must separate tariff changes from the underlying state of the economy. Conducting a narrative review of U.S. policy since 1870 and found that tariff changes were often "quasi-random" regarding the business cycle.

Historically, Republicans and Democrats held diametrically opposed views on protectionism. For example, during the high-unemployment periods of the late 19th century, Democrats favored lowering tariffs to assist consumers, while Republicans favored raising them to protect northern industries. Because political power flipped frequently, the direction of a tariff change was often dictated by ideological preference rather than economic necessity. This historical "noise" allows researchers to observe the impact of tariffs across various economic conditions.

Tariffs as Aggregate Demand Shocks

The sources reveal a consistent pattern: regardless of the time period (pre- or post-World War II) or the country (U.S., UK, or France), a tariff hike leads to a contraction in economic activity and a decline in inflation. In the pre-WWII U.S. sample, a 4-percentage-point permanent increase in the tariff rate lowered inflation by 2 percentage points and raised unemployment by approximately 1 percentage point.

This finding suggests that tariffs do not behave like "cost-push" shocks—which typically raise prices while lowering output—but rather like adverse aggregate demand shocks.

Why Do Tariffs Lower Inflation?

The researchers identify two primary channels through which tariffs depress aggregate demand and, consequently, prices:

The Uncertainty Channel: A tariff shock creates or coincides with an uncertain economic environment. This uncertainty erodes consumer and investor confidence, causing a pullback in spending that puts downward pressure on inflation.

The Wealth Channel: High tariffs are strongly correlated with a decline in asset prices. The data shows that tariff increases lead to lower stock market valuations and increased market volatility. This reduction in household and corporate wealth further suppresses demand and lowers the price level.

Global and Modern Evidence

While the volatility of tariffs has decreased significantly in the post-World War II era, the researchers found that modern data still points in the same direction: higher tariffs correlate with lower inflation and higher unemployment. Furthermore, independent data from the first wave of globalization in France and the UK confirms these results. In both European cases, tariff hikes were followed by declining inflation and contracting GDP growth.

So How Will It Look Like Today?

The theory that tariffs lead to inflation is considered flawed primarily because it overlooks historical data, logical consistency regarding unemployment, and the strategic responses of global competitors like China.

Here are the key reasons why the 'tariff inflation' theory is challenged today:

1. The 1-Year Lag Effect

Historical patterns suggest that while tariffs might not immediately lower prices, they tend to trigger a deflationary "crash" after a certain period.

2018 Example: During the US-China trade conflict in 2018, many expected immediate inflation, but the economy remained strong that year.

2019 Reality: By 2019, the economy began to struggle significantly, which is described as the "1-year lag effect" of tariff-induced deflation.

2. Historical Data (150-Year Analysis)

A Federal Reserve economist report analyzing 150 years of tariff events shows a surprising trend: as tariffs increase, inflation actually tends to decrease.

The data points from over a century of economic history consistently show a downward-sloping regression line, meaning higher tariffs correlate with lower prices over time.

3. Logical Contradiction with Unemployment

The theory is also considered flawed today because it ignores the impact of tariffs on the broader economy.

Rising Unemployment: Data shows that tariffs lead to higher unemployment rates.

Economic Slowdown: It is logically inconsistent to argue that prices will continue to rise (inflation) while the economy is worsening and more people are losing their jobs.

4. China’s "Dumping" Strategy

China’s response to global pressure and tariffs often involves ramping up manufacturing to maintain its industrial dominance.

To weaken the manufacturing sectors of potential adversaries, China exports high-quality goods (like EVs) at extremely low prices.

This massive influx of cheap goods creates significant deflationary pressure globally, counteracting the expected price hikes from tariffs.

For economists and financial professionals, these findings suggest that the inflationary impact of tariffs may be overestimated in standard models. If tariffs primarily act as a drag on aggregate demand by triggering uncertainty and depressing asset prices, the "optimal" monetary policy response may not be to tighten interest rates to fight inflation, but rather to manage the resulting economic slowdown and potential deflationary pressure.

As the global trade landscape continues to shift, understanding these general equilibrium effects is crucial for accurately forecasting the macroeconomic trajectory of protectionist policies.