US Counter (2/2) Is the Global Chessboard Really Controlled by Crude Oil?

When we talk about geopolitics and global power struggles, our minds usually jump to trade wars, high-tech competition, or military might, right? But I’ve found that those surface-level conflicts often mask a much deeper, older game: the race for energy dominance . Many experts suggest that recent major political moves—moves that seem disjointed on the surface—are actually steps in a massive, coordinated effort by the U.S. to redefine global energy security and, critically, seize back the control of pricing and supply. We’re moving beyond just securing oil for ourselves; we’re talking about securing the entire global economic foundation . This isn't just economics; it's the ultimate struggle for global supremacy, with crude oil acting as the silent, indispensable weapon.

What’s interesting is how the U.S. managed to flip the script on energy. Since the 2008 shale revolution, America has become the world’s top oil producer, achieving an astounding energy self-sufficiency rate that exceeds 100%—a truly surprising fact for a country that consumes the most energy globally . Yet, despite this domestic abundance, America’s strategic focus is now on controlling key international supply points, particularly those that impact rivals like China and support allies in Europe. The U.S. isn’t just resting on its laurels with its domestic supply; they understand that true power lies in controlling the flow and the price globally, effectively creating an energy chokehold that they can selectively release or tighten.

This leads us to Venezuela. While the official narrative often focuses on stabilizing global oil prices or accessing heavy crude for U.S. Gulf Coast refineries—which were historically built for that very type of oil—some analysts see a bigger, more strategic move . By re-accessing Venezuelan reserves, which are absolutely enormous, the U.S. gains capacity to flood the market with cheap, American-controlled oil . This is crucial because it gives the U.S. leverage over Europe, countering Russian influence, and, more importantly, it offers a direct, powerful counter-punch to countries like China who rely on certain suppliers. If the U.S. can single-handedly set the floor price for oil, they fundamentally gain control of every nation’s economy that relies on imports—a true game-changer in the global power dynamic.

Why is Europe’s Political Shift a Win for U.S. Energy Strategy?

Let's turn our attention to Europe, because this is where the energy game gets really complex and political. When the Russia-Ukraine conflict started, Europe agreed to cut off Russian natural gas, which was a huge geopolitical move, but it left many European nations scrambling for energy and relying heavily on U.S. imports . However, cheap Russian energy was what fueled Europe’s economic strength and kept prices stable for years, allowing them to build strong export industries . The current high-cost environment has caused severe financial strain, with some governments having to spend billions on subsidies just to keep lights on and temper popular discontent .

What’s fascinating is the political blowback this is causing: we're seeing a rise in so-called "far-right" political parties across Europe, including significant gains in countries like Germany and Austria—a major shift that hasn't been seen since WWII . And here’s the counterintuitive insight: a core tenet of many of these rising European parties is a desire to return to a "pro-Russia" stance, specifically to regain access to that cheap, abundant Russian gas . They argue that severing ties with Russia primarily benefits American interests, not European citizens struggling with rising costs.

This political instability creates a precarious situation for the U.S. because a pro-Russia shift would undermine America's strategic alliances and diminish its role as Europe's primary energy guarantor . To preempt this, the U.S. needs to offer an equally, if not more, attractive energy alternative to keep Europe firmly within its sphere of influence. This is where Venezuela and even the vast reserves in places like Greenland come into play—Greenland holds an estimated 17% of the world's oil and 30% of its natural gas reserves, a staggering amount . If the U.S. can access and efficiently export this massive new volume, it can essentially tell Europe, "Don't bother with Russia; we will supply cheap, secure energy," effectively cementing its position as the ultimate global energy arbiter, dictating prices and supply to ensure allied compliance.

Can China Win the Trade War if America Controls the Faucet?

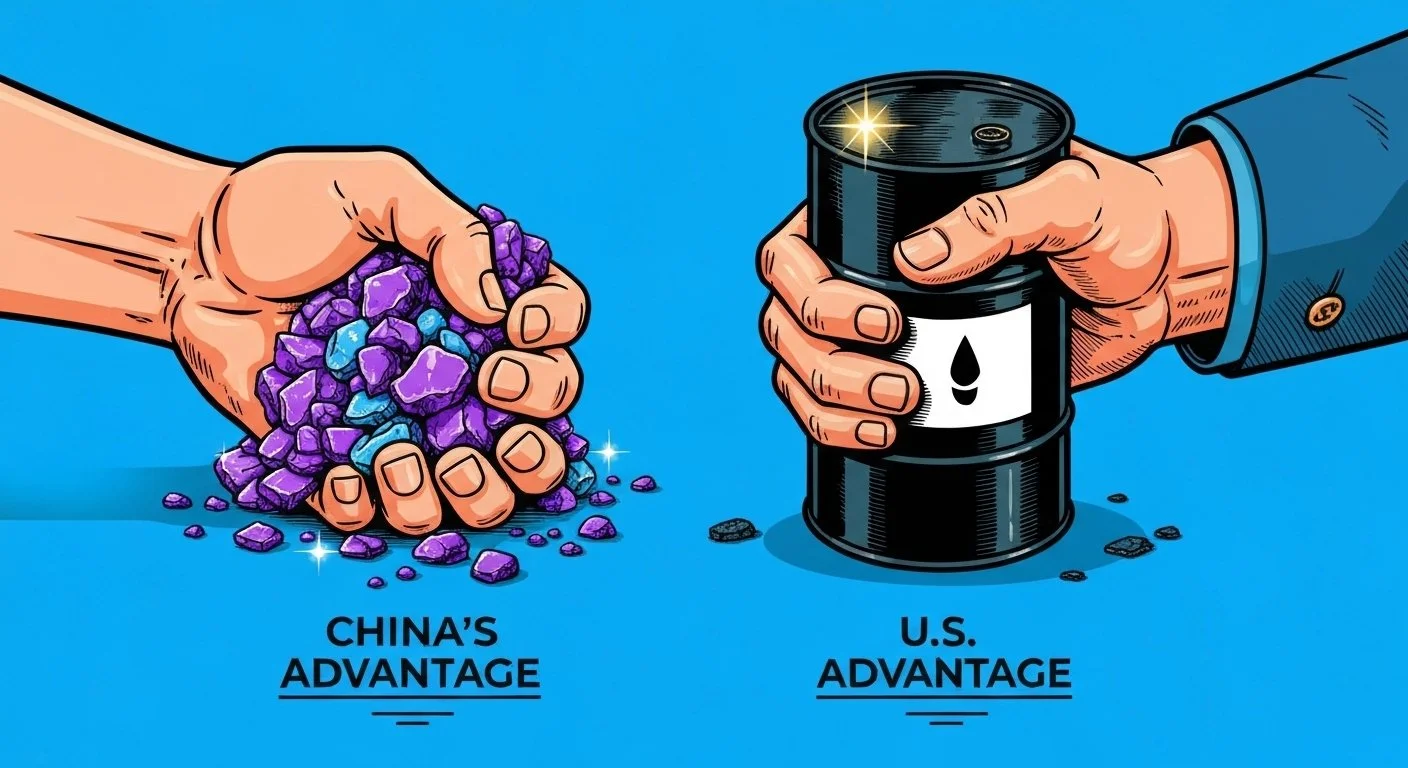

Now, let's look at the ultimate strategic target: China. China might have the upper hand in certain critical resources, like Rare Earth Elements (REEs), which are vital for U.S. technology and defense industries—a genuine "chokehold" on America . But here’s the strategic pivot: if the U.S. controls the global oil supply, it can turn the tables because oil is the lifeblood of everything—manufacturing, logistics, and military movement. Controlling crude oil allows the U.S. to threaten China’s economic stability in a way that REEs alone cannot match. I’ve found that even a minor disruption in global oil flows can send entire economies spiraling, something China cannot afford.

To understand China’s vulnerability, we need to examine its top oil import partners. While Russia became China’s number one supplier after the Ukraine war, and Saudi Arabia holds the second spot, the rest of China's major suppliers are heavily influenced by the U.S. . For instance, Iraq, China’s third-largest supplier, remains significantly under U.S. influence, with American troops still stationed there and substantial control over its financial and oil systems . Similarly, Brazil, a significant supplier, practices careful "balanced diplomacy" between the U.S. and China, but U.S. foreign direct investment and trade volume give America considerable leverage.

The most fascinating part of China's supply chain is the "hidden" oil coming from Iran. Due to U.S. sanctions, Iran’s oil is often routed through intermediaries like Oman and Malaysia—which act as major suppliers to China—to launder the origin, allowing China to import it at a cheaper price . However, political instability in Iran, driven partly by young people using smartphones to see the outside world and demand change, suggests the current authoritarian regime’s power is weakening . This potential shift toward market liberalization or democracy in Iran would inevitably increase American influence, making that vital oil flow to China vulnerable . If America can pressure Iraq, leverage Brazil, maintain allies like Kuwait, and destabilize the Iranian-routed supply, China is left depending almost entirely on Russia and a potentially reluctant Saudi Arabia. From my experience watching these global maneuvers, it’s clear that China’s dependence on these volatile or U.S.-influenced suppliers means that America is quietly securing a much larger grip on the global economy than just the domestic shale revolution suggests.